By: Jeff Heybruck

Not all clients are created equal. Some are more profitable than others, and some are just plain difficult to manage.

In last month’s Small Business Tips, we recommended that businesses stratify – or separate into groups from most ideal to least ideal -the client base. In this post, we’ll dig deeper into that concept, providing a sample model for scoring and yes, even a downloadable template you can use to complete the exercise.

Strat•i•fy verb — to arrange or classify.

Why Stratification?

Before we look at how to score a client base, let’s discuss why it’s a valuable exercise in the first place. Scoring and then stratifying the client base takes an otherwise subjective exercise (which clients we may ‘think’ are best) and turns it into an objective one. The outcome is actionable data that can be used by leadership; these scores can be used to make informed business decisions, including:

- Development of Products & Services. With a better understanding of a client base, more informed decisions can be made about pricing and product or service development. For example, clients all using a specific line of service shown to have lower margins might indicate the need to either drop that service (if the product or service is not essential) or redevelop it to be more profitable.

- Marketing and Sales Strategy. A better understanding of which clients are ideal means leadership can focus marketing and sales efforts on those most ideal for the business – both for upsell and cross sell of existing customers and when to say “yes” to new customers.

- Changes to Policies/Procedures. For low-scoring clients, the business can update its policies or procedures to address core issues identified. For example, by identifying clients who are slow to pay, the business can take steps to collect payments on time, including updating payment policies and procedures. Perhaps they have been slow to pay because we are taking too long to invoice or not following up on invoices in a timely manner.

How To Stratify a Client Base

Step 1: Determine Criteria

First, determine the criteria that, if met, would signify an ‘ideal’ client. The specific criteria used will depend on the industry, business type and its goals, but for the sake of example, we’re going to recommend a few that score each client based on Profitability, Volume, Collections, and Ease. Here’s a few we came up with:

- Margin Score: This measures the profit that you make on each client. Margin, represented as a percentage, can be calculated by dividing gross profit by revenue.

- Revenue Score: This measures the total revenue that each client generates within the period used for scoring (typically annually).

- Days to Pay Score: This measures how quickly each client pays their invoices, in days.

- Ease Score: This measures how easy it is to manage and work with each client.

Ok, so this last criterion might be a little bit subjective. If a client is a big pain to deal with, a bad culture fit, or staff just don’t enjoy working with them that can be factored into this score. That being said, most of these ‘subjective’ calls impact real metrics, like employee turnover and wasted time and resources dealing with difficult customers, which translate into real business losses.

Step 2: Assign Weight by Criteria

Now that the criteria are determined, assign a weight to each criterion to signify its importance as a part of the whole. Think about which criteria impact the business most. In most cases, you would not assign criteria equal importance (ie. you wouldn’t assign 4 criteria each a weight of 25%).

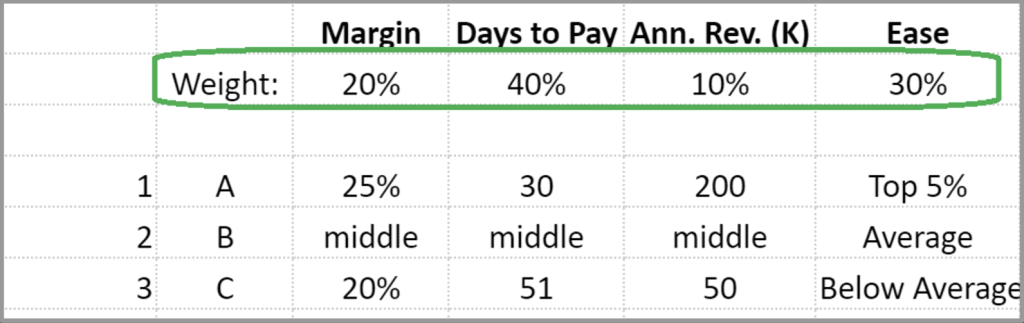

Take the below example. In this Model, “Days to Pay” is weighted at 40%, followed by “Ease” at 30%, “Margin” at 20% and “Annual Revenue” at 10%. If collection is a non-factor that criteria might get a lower score with the rest being allocated to, say, Margin. For the below client (and the one we developed this model for) Collection Speed was one of their biggest factors in determining who they liked to work with. “Do they pay on time?” was the constant question.

Sample Weighted Ranking Model

This model says a few things. Cash is king and customers that pay late are not ideal. Even at a high revenue and good margin, this business cares about the experience of its staff – clients that are a pain may not be worth it. Lastly, the bottom-line matters more than the top line – as it should – with Annual Revenue weighted at a lower percentage than Margin.

Step 3: Determine Criteria Thresholds

Next, determine 3 threshold levels per criteria, to give each client a score of 1-3 per criteria.

In our sample model, for the Margin Score, any client with 25% or higher profitability gets a score of “A”. Any client that takes 51 days or longer to pay gets a low “C” for “Days to Pay.” And Ease is simplified by asking the business to think of the Top 5% of the client base that they know is a pleasure to do business with vs. average or below average.

Step 4: Score Each Client by Criteria

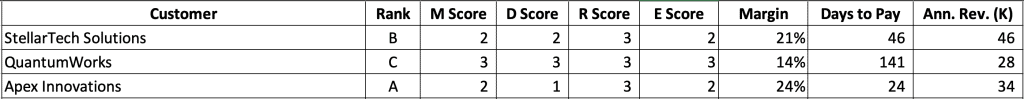

Once the thresholds are determined, begin assigning a score of 1-3 per the threshold criteria by client and criteria. For example, in the Sample Scorecard below, we can see that QuantumWorks scored in the highest threshold across all 4 criteria – Margin, Days to Pay, Revenue and Ease.

Download a sample Excel worksheet

You can download a free sample worksheet complete with weighted formulas using Microsoft Excel.

Step 5: Stratify

Once each client receives a score, you can group them into different categories, or “strata.” In our sample model, there are 3 – A, B, and C. The business may decide to create an action plan by client or by Strata for how to move forward. For example, maybe all “A” clients get a handwritten thank you note or token of appreciation. Or maybe all “C” clients are analyzed by the most common low-scoring criteria to see if there is something within the business’s control that can be improved upon (eg. Margin) or not (eg. Ease). In our real-life example, a salesman immediately picked up the phone and called his 3-4 “A” clients. Two of them thanked him for the call and said something to the effect of “since we got you on the phone, I have a couple projects I want you to bid on…”

Tips for Stratifying a Client Base

Here are some additional tips for scoring and stratifying a client base:

- Consistent = Meaningful – Scoring methodologies should be consistent for scores to be accurate and reliable. Getting the model as close to ‘right’ the first time will ensure the business can calculate cumulative scores over the years. If the criteria, weights or thresholds change from year to year, make sure to recalculate cumulative scores, to ensure an apples-to-apples comparison.

- Review & Use – Leadership should review scores on a regular basis and create an action plan. We recommend doing this annually and giving a cumulative score vs. looking at that client within only a one-year period. This will help you identify changes in the client base and adjust strata accordingly.

- Considering ‘X-Factors’ – There may be certain “X-Factors” that are not formally factored into the model, but still matter. Take customer referrals for example. While we wouldn’t want to score a client lower just because they don’t provide referrals, one that does might be more ideal than one that doesn’t. For example, a customer that might typically have received a “B” score across every other metric – Days to Pay, Revenue, etc. may be bumped up into “A” category if they are regularly providing strong referrals that turn into additional business.

We hope you found this sample model above helpful. Don’t have the internal resources to perform this exercise or need help calculating the existing data needed to score clients? Our fractional CFOs can help with exactly this type of strategic exercise. Book a consultation with one of our CFOs here.