By: Jeff Heybruck

Retainage, also known as holdback, is a common construction industry practice where a percentage of a project’s payment (usually between 5% and 10%) is withheld until work is completed to the client’s satisfaction. Failing to track retainage appropriately can create confusion such as mismatched Accounts Receivable, under or overstated revenue, cash flow & profitability mistakes and even potential tax issues. Managing this is not difficult, but it will take some setup and discipline.

Companies often find all kinds of creative ways to work around this issue which can have downstream implications, reducing Confidence in the Numbers. Below, we’ll walk through how to handle the proper setup in QuickBooks.

Out-of-the-box, QuickBooks doesn’t have a feature to track retainage. We’ve seen this lead to all sorts of incorrect handling of retainage in the books – from future-dated invoices that just keep getting pushed out to showing the full amount of the invoice entered as if due before it really is (in other words the amount entered into A/R didn’t account for the retainage).

Without a system in place, it’s easy for retainage to inflate A/R and skew cashflow data. It’s also easy to lose track of what retainage is still outstanding vs. what needs to be collected now.

The good news is that QuickBooks Accounts and Items can be used to create a retainage tracking solution for confidence in the data. Here’s how:

- Create a “Retainage Receivable” Account

- Go to “Chart of Accounts” or “Lists” > “Chart of Accounts”

- Create a New Account

- Select “Other Current Assets” as the “Account Type”

- Name the Account “Retainage Receivable”

- Save the Account

- Create a “Retainage” Item

- Go to “Lists” > “Item List”

- Click “New”

- Name the Item “Retainage”

- Leave the “Rate” or “Price” blank

- In the “Account” field, map the Item to the “Retainage Receivable” account (created in Step 1 above)

- Save the item

- Create Initial Invoice

- Create an invoice for the full amount (including Retainage) as if there were no retainage involved. Use as many lines or service items as required.

- Add the “Retainage” item

- Enter the Retainage amount as a negative number (e.g. -1000) (this will reduce the total amount on the invoice)

- Review the Invoice total amount (it should reflect the amount due after Retainage is withheld)

- Save the invoice and close

- Send the invoice to the Customer

- Initial Payment

- Record the payment received against the initial invoice which should cover the full amount of the invoice in Accounts Receivable.

Once the job is complete or some threshold has been met that triggers a release of Retainage, it’s time to move some or all the Retainage from the Retainage Receivable account to Accounts Receivable.

- Create Final Retainage Invoice / Release of Retainage

- Create a new invoice

- Add the “Retainage Receivable” item (this time enter the Retainage amount as a positive number)

- Review the invoice total amount (it should reflect only the amount of the Retainage)

- Save the invoice and Close

- Send the invoice to the Customer

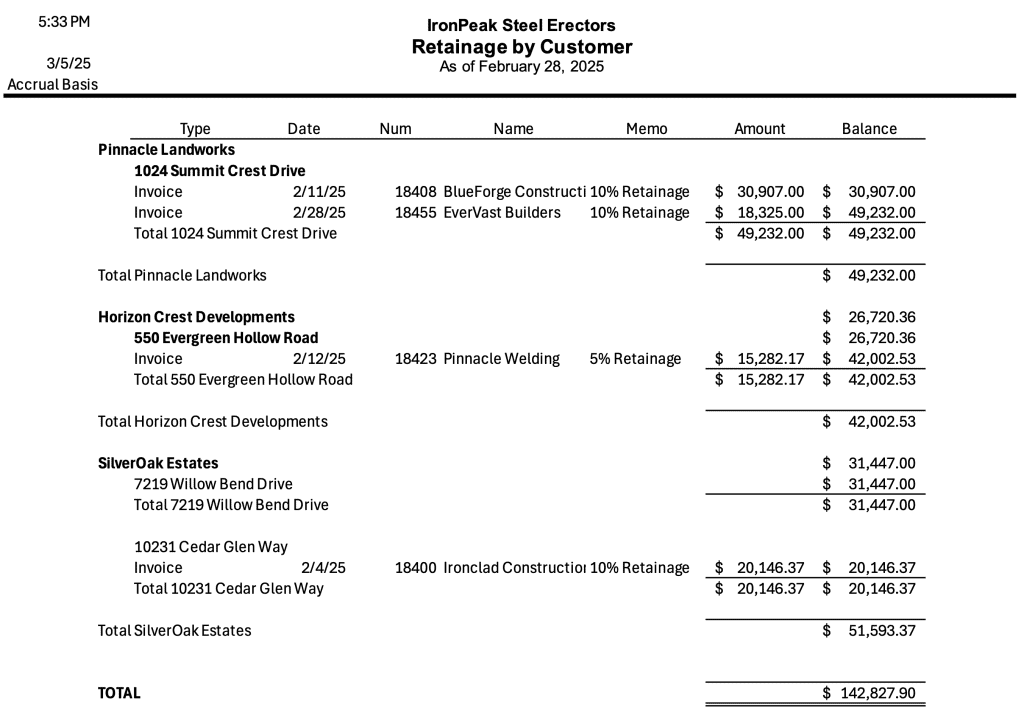

Reporting Tip: At this point, the percentage of the invoice being held in retainage will show under the “Retainage Receivable” account created earlier. A separate account will show on the Balance Sheet; click into it and rename the Transaction Detail Report something like “Retainage by Customer.” It’s good practice to look at this report monthly and identify any opportunities to invoice for the retainage. Here’s a sample of what that looks like:

Note: If only collecting a portion of the retainage (e.g. 50%), a third invoice will need to be created when ready to collect the final payment. Only invoice for the amount that can be collected at the time.

Now let’s apply these steps to an example. Let’s say a $10,000 construction job is completed with 10% retainage.

- Initial Invoice: Create an invoice for $10,000.

- Retainage Entry: Code -$1,000 to the Retainage Item on the Initial Invoice. The Invoice Total Amount should now be $9,000.

- Final Invoice: Upon project completion, create a new $1,000 invoice for the retainage and apply the payment to this specific invoice when received.

That’s it! If you need help with confidence in the retainage and cashflow data and related reporting in QuickBooks, please schedule some time with our team.

A Brief Note on Credit Memos: You may have an accountant that recommends tracking retainage using credit memos. Credit memos, while valid, can be seen as adjustments to existing invoices, rather than distinct transactions, which does not provide as clear of a picture of the retainage release. Credit memos also affect the profitability of a job which retainage does not. Retainage is a cash flow issue. Not a profitability one. Creating separate invoices aligns with the revenue recognition principle, which states that revenue should be recognized when it is earned. Separate invoices enable the generation of accurate reports on project profitability and cash flow – for confidence in the data.