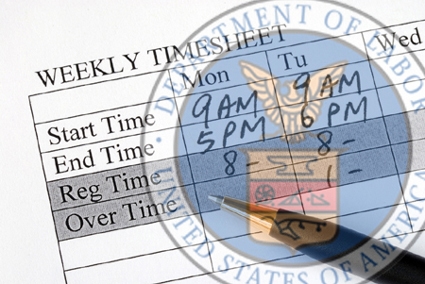

The new U.S. Department of Labor (DOL) ruling regarding overtime for exempt employees takes effect December 1, 2016. The revised minimum yearly salary to be exempt from paying overtime will be $47,476, compared to the previous $23,660 per year.

To be exempt from overtime rules and pay, the employee must have a salary that exceeds $47,476 and meet the duties test requirements. Below the threshold, a salaried employee qualifies for overtime pay for working over 40 hours a week. The new ruling also increases the compensation level for highly compensated employees (HCEs) from $100,000 to $134,004 per year. The DOL anticipates that the new ruling affects 4.2 million workers across the country (approx. 156,000 in North Carolina)*. But the new ruling will have an impact on all salaried hires going forward. Businesses with exempt employees need to take six steps to see how they will be affected:

1. Identify exempt employees making less than the salary threshold ($47,476/year, or $913/week). Non-discretionary pay, such as bonuses and commissions, may count for up to 10% of the salary threshold if the payments are made on at least a quarterly basis.

2. Estimate amount of overtime for the employees identified in the step above. Because tracking overtime isn’t necessary until December 1, talk with supervisors or managers to estimate a typical amount of overtime work.

3. Determine if the duties of the employees will require them to be changed from exempt to non-exempt. Employee classification is not always clear, and the burden of proof falls on the employer regarding correct classification. Broadly, exempt employees are those that are executive, administrative, or professional. Types of jobs that are frequently misclassified are entry level positions, admin assistants, paralegals, inside sales, and buyers.

4. Consider options for managing the new rule with minimal administrative issues:

- Increase an employee’s salary to make it above the overtime threshold.

- Convert the employee to non-exempt and pay overtime.

- Hold hours to 40 per week.

- Hire more workers as part-time employees.

5. Evaluate whether job descriptions need to be revised if jobs change from exempt to nonexempt. Review exempt job descriptions to verify that the job meets the duties tests.

6. Be aware of how the change from exempt to non-exempt may affect an employee’s perception of his or her job. Non-exempt may be perceived as less professional, and make the employee feel like they have less flexibility. Plan in advance how to communicate the changes to affected employees to assure a smooth transition.

Duties Tests

The duties tests remain the same as before regarding exempt vs. non-exempt employees. The categories for exempt employees are executive, administrative, and professional. Also included are outside sales and certain computer-related positions. All are called ‘white collar’ exemptions. Employees who are on salary making above the threshold, but below the HCE definition and without the following white collar duties remain eligible for overtime pay.

Executives:

- Primary duty is managing the business or a department

- Supervise 2 or more full-time employees (or equivalent)

- Have authority to hire/fire or recommend status of other employees

Administrative:

- Primary duties are office or non-manual work directly related to the management or business operations of the employer or employer’s customers

- Duties require ability to exercise judgement and discretion

- (Different rules apply to academic administrative employees)

Professionals:

- Possess an education higher than high school

- Possess specialized education resulting in an advanced degree

- Required to exercise discretion and judgment in their responsibilities

- (Includes creative professionals, teachers, those practicing law or medicine)

Automatic Updates

The salary threshold for overtime and HCEs will increase every three years to maintain levels above the 40th percentile of earnings for determining overtime, and 90th percentile to determine HCEs.

The definitions for employee classification are complex. Once an employer has a rough idea of how to work within the new DOL regulations, it is a good idea to confirm the decision(s) that required changes with an HR attorney. The potential penalties for misclassification far outweigh the expense of hiring a professional to review/confirm duties and classification.

*Source: Department of Labor Overtime Rule